R

eady to build your ideal customer profile?

This integral marketing intelligence document will empower you to uncover exactly what your ideal client wants vs. what turns them off… and how to position yourself right where they’re looking.

Strategically profiling customers plays a crucial role in how easily we get clients vs. how hard we have to work, as well as in how fast we can grow our business, how much market share we secure, and more.

Note: In this guide, we’re creating an Ideal Customer Profile for a financial advisor. But you can use this process when building a customer profile for any service business.

You can also outsource this time-intensive process, and hire us to build customer profiles for your consultancy, coaching program, or advisory business.

To ensure that we start out on the same page, let’s first define “customer profiling.”

What’s the definition of a “customer profile”?

Your customer profile (or “target market profile”) is the prototype your business compiles and uses to identify, understand, and attract your target client.

Note that we’re taking this a step further and calling this your ideal client profile, because as I continually preach, we don’t just want “clients.”

We want to attract our exact, ideal, high-value client as much as possible.

So it only makes sense to focus only on profiling the customers in this guide that we MOST want to serve.

As such, to ensure that we have a well-rounded view of our target audience, we’ll build a complete Ideal Client Profile that covers demographics (customer “stats,” like gender, age, and race), psychographics (lifestyle factors and how your audience makes decisions), and geographics (where are your ideal clients, and how does that influence how we reach them?).

What you’ll learn today:

- How to define the most likely person ready to buy from you immediately

- How to discover and understand your ideal client’s daily life, personality, and pet peeves

- How to uncover the needs, language, and truest desires of your ideal client

- How/where to gather “intel” to know exactly how to push their buttons (in a good way — and bad)

- How to compile a shortlist of sample places to find MORE of your perfect clients

- And more.

By the end, you’ll be set to build your own Ideal Customer Profile for your desk, your wall, or to give to your team for a quick and ready reference.

Note: A few entrepreneurs get their knickers in a twist when we say we’re defining our ideal “clients,” as opposed to our “prospective” or “potential” clients.

However, semantics are irrelevant, so long as you build a strategy to help you think about the type of client you truly WANT in your business, instead of settling for anyone who drifts (or is referred) in.

Let’s start!

- Why Choose One Specific, ”Perfect” Client Type Instead of “Widening Your Reach”?

- Must-Haves Needed to Start

- DEMOGRAPHICS: What are your customer’s “stats”?

- What ethnicity is your Ideal Client?

- How old is your Ideal Client?

- What gender is your Ideal Client?

- What’s your Ideal Client’s marital status?

- What major life experiences have shaped your Ideal Client’s character?

- What type of work does your Ideal Client do? What field are they in?

- What’s the education level of your Ideal Client?

- How many children does your Ideal Client have, and do they live at home?

- What are your Ideal Client’s passions and hobbies?

- What are up to three cities or states where your Ideal Client resides?

- What’s your Ideal Client’s income?

- PSYCHOGRAPHICS: Becoming Omniscient in the Eyes of Your Ideal Client

- Next-Level Targeting: Customizing Your Findings with Industry-Specific Data

- “Meeting” Them Where They Are (Literally): How to uncover top hangout spots, on- and offline.

- Segmenting: How to Process Major Differences in Client Types

- Making the Perfect Client Profile a Part of Your Routine

Most businesses seem to think that the smaller we focus, the smaller the pond of leads we’ll have to “fish” in to secure clients.

In contrast, that couldn’t be further from the truth. The opposite, actually, is proven to happen:

The smaller the “pond” we look within, the easier it is to catch a “fish.”

The main benefit of being exacting is that whenever THAT specific client sees your message… they feel it was written SPECIFICALLY to them.

In other words, they automatically believe that you understand them better than others offering similar services… even before you say that you do.

In other words, they automatically believe that you understand them better than others offering similar services… even before you say that you do.

And you actually ARE able to get at their exact needs much more efficiently than when trying to address what 10 different client types are needing, thinking, or feeling.

And here’s another important point:

The average conversion rate across industries is just 1 to 2%.

This means that, AT BEST, just 2 out of 100 people who see your initial message are ready and willing to buy or sign right then.

For example, let’s say 100 people see your Facebook Live video, and 20 of those viewers visit your website.

Of those 20 visitors, then 5 of them sign up for your list, and 2 of those signups become clients.

What made those 20 viewers visit the site?

What made five of them sign up for your offer?

More importantly, what made those two signups become clients?

That’s what this guide will help you get after.

If we focus on finding those 2 most likely buyers and ignore everyone else for now, our work becomes, once again, so much easier and more cost effective. We don’t have to water ourselves down to cater to the personalities, wants, and needs of the other 98 people.

And why cater to someone who’s not ready to buy from us anyway?

In summary, when profiling a customer, don’t shy away from getting specific. Customers love that. You can even boldly proclaim your affinity for your perfect clients right on your website.

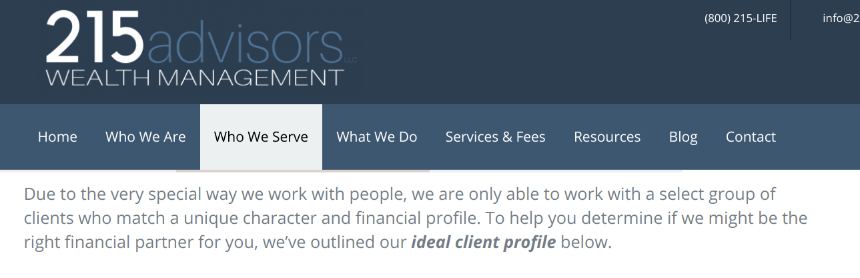

Example from 215advisors with Ideal Client Profile outlined on website:

So let’s get to work.

-

A specialized service (or product) that solves an important need, or soothes an important pain, for a specific type of person.

-

To have generated revenue for that specialized service or product, having at least three paying clients.

- RECOMMENDED: At least one existing client for your service who you view as “ideal.”

The easiest way to gain a lot of the intel below is to ASK your existing Perfect Clients, in exchange for an amazing reward (i.e., 30 extra minutes with you, a valuable whitepaper, etc.).

However, even if that’s an option — or even if you’re basing your Perfect Client on you — it’s still good practice to complete this process. You’ll uncover lots of nuanced data that you can’t get directly from your typical client (who’s not an intimate friend).

No “perfect” paying clients? Use these three demographics instead.

If you don’t have clients yet (for the exact service you expect to sell), no problem. Just list some initial characteristics of what you’d want them to look like.

Start with these three basics:

- – profession or age

- – minimum income

- – ethnicity

Remember, this PCP is designed to be a thorough starting point, but it’s also a work in progress. You should be revising and adding to it, the more you work directly with your Ideal Client.

A final tip before starting:

Though it’s fine for our purposes, you’ll be searching data mostly available to the general public. This is more limited than a research company would have access to.

With that in mind, if you’re ever unable to find data for a search, or if nothing stands out, you can probably assume that data point isn’t super significant to your market. In those cases, either leave it out of your Perfect Client Profile, or just choose one side or another.

When outlining demographics, be sure not to arbitrarily choose random statistics. Instead, research the most likely statistics of the people who use the exact solution you offer.

Again, these customer profile demographics are for your ONE, truly ideal, highest-value client.

Remember, the profile we’re compiling should not be a “catch-all” for every type of client we may accept.

For example, here’s how building a set of specific, ideal customer demographics might look for Langston, our CDFA/Financial Planner who wants to target newly divorcing professors.

First, if you have a few dozen existing clients, what is their typical ethnicity? What’s the ethnicity of your Perfect Client(s)?

Do you think either factor was important to why or how they chose you?

You might choose this either based on 1) your current typical client, 2) the client you’d feel most comfortable working with, or if you’re seeking to widen your niche as much as possible, 3) the ethnicity most likely to fit the stats you already selected (income and profession/age).

Note: It’s risky to base it on who you currently believe is “most likely to fit” your existing data. We carry around unconscious biases and confirmation biases that make our “beliefs” on these matters not at all fact-based.

E.g. Statistics show thousands of ultra-high net worth African American households in the U.S., and more than 1.1 million wealthy-to-HNW households. However, mainstream media bias brainwashes us into believing that all Black households are poor, unless they’re athletes or entertainers.

Remember that we tentatively set gender when we began, since Langston didn’t have any truly “Perfect” Clients to base his research on. He assumes whites have a high enough divorce rate for him to be comfortable with his niche size, but he wants to check the data before finalizing his decision.

A quick search of “ethnic group most likely to get divorced” turns up data that Native Americans (at M: 44%, F: 45%), as well as those with a high-school education or lower (at M: 39%; F: 37%), are actually the most likely groups.

So, one idea for our CDFA might be to focus on both groups in one, basically meaning he’d serve Native Americans with a high school or lower education.

Tip: However, Langston should consider his fees, as well as the lower average income of a worker with a high school education.

He should think also about the services he offers, and decide whether they’ll fit the budget and true needs of that demographic.

Combine the data from your existing Perfect Client(s) and the research you find in order to make a hypothesis here.

For this example, we’ll assume our example Financial Advisor starts strongly considering targeting Native American clients. So he changes his “ethnicity” demographic from white to Native American before moving on.

First, if you have a few dozen existing clients, what is their average age? Then, what’s the age of your Ideal Client? Do you think either is important to why or how they chose you?

Again, if we google “age groups most likely to be divorced,” we find that the most likely group is age 20 to 29. More specifically, the highest concentration of those is between 20 and 24 (M: 38.8%; F: 36.6%).

Again, our CDFA has to consider his fees and services against the average income and needs of that age group to determine whether it fits.

Also, since our example Financial Advisor is a CDFA for university professors… he has to consider that their average age is 55.

And he’ll be hard-pressed to find very many professors under Age 40, much less between 20 and 24!

Already, our Advisor has some decisions to ponder:

Should Langston choose a new profession more common to 20- to 24-year-olds?

Or should he continue to target university professors, with the knowledge that the divorce rate for people Age 40 and above is only 9.1% (F) and 5.8% (M) (as opposed to 36.6 and 38%, remember, for the 20 to 24 age group)?

Let’s assume he sticks with university professors, (who are average Age 55)… since all his marketing materials already say that he’s a CDFA for professors!

First, if you have a few dozen existing clients, what is their average gender? Then, what’s the gender of your Perfect Client? Do you think it’s important to why or how they chose you?

Looking at the divorce rate data by gender, our resourceful Financial Advisor, Langston, might decide to target females, because they’re more likely than males to get divorced after 40.

Langston obviously knows this one, because he’s choosing people going through a divorce. (It’s typical that we’ll know at least one piece of demographic data for certain.)

But if he didn’t know?

He’d try to find this data as it relates to the profession, the age group, or the minimum income. For instance, if he were targeting white race car drivers making $56,000/yr, he’d search “what percentage of race car drivers are married.” Or maybe “average demographics of race car drivers.”

Remember that if unable to find anything that stands out in the data available to the general public, he can assume this stat isn’t significant. Then he’d either leave it out of his Ideal Customer Profile, or simply choose one side or another.

First, if you have a few dozen existing clients, what experiences that they consider major have happened in their lives? Have you noticed a pattern? If so, do you think it’s important to why or how they chose you?

Because our Financial Advisor is now strongly considering targeting Native Americans, he searches Google for “major life experiences of Native Americans in the U.S.” He then remembers or finds that they’ve had a tumultuous and difficult history in this country, due to the attempted colonization of their land.

We can only begin to imagine how this hardship affected their ancestors, and how it must residually affect how they experience life in the U.S. today.

But instead of “imagining” (we’re being strategic here), we’ll just search: “What are some issues facing Native Americans today?”

And then, we discover that they are likely having difficulties with:

Historical trauma and hopelessness

Historical trauma and hopelessness- Major health challenges

- Loss of Native American culture and identity

- Property struggles

… and more.

Again, Langston has some decisions to ponder.

Does he want to further target his products and services? (For instance narrowing his focus to more health-related or property-related offerings, to serve Native Americans’s specific needs better?)

Or, will he decide that he prefers not to target a double-traumatized group, sticking only to female divorcees, Age 40 and up?

IMPORTANT NOTE: If we decide to target a traumatized market, whether divorcees, Native Americans, Black/African Americans, or any other group, it’s our responsibility to dig deeply into the research to understand that trauma.

This way, we develop a genuine concern, and truly understand the struggles, fears, hopes, and worries of our target audience, so that we can serve them responsibly, ethically, and empathetically.

(This can be an important step EVEN IF you’re a member of that group. Because being a member of a group doesn’t mean that we experience life’s highs and lows the same as every other member.)

Our sample Financial Advisor has a hard think, and decides that trying to pivot to target Native Americans would be time-prohibitive for his current resources. He’d have to study them intensely to be able to first understand, then rightly provide for their needs. And then he’d have to retarget his messaging to speak directly to Native Americans. (Remember that he’s an African American male CDFA.)

Native American culture is completely foreign to Langston. And while he’s empathetic to and would like to understand more about their plight, this fact, combined with the finding that their communities generally keep funds within their own culture, tells him that he should not specifically seek to mold his marketing in that direction.

So then, our Financial Advisor Googles “major life experiences of white females in america.” Not surprisingly, he comes up with numerous articles about the Black experience in America.

Again, unpacking that world view enough for the CDFA to both understand it and use it to his marketing advantage could prove very challenging.

He tentatively changes his Perfect Client’s ethnicity to white. But he waits to gather more data before ultimately deciding what to do.

Of course, we already know that the Advisor is targeting professors.

To help with the ethnicity question, now he decides to search for “university professors by ethnicity.”

When he does, he finds that 3% of university professors are Black women, while 27% are white women. So he decides to roll the dice.

He estimates that winning the trust of white female university professors, relating to their experience, and getting them to choose him over a non-Black Financial Advisor could be more difficult than simply targeting Black female professors. Even still, he’s relying on the numbers to pay off.

Our sample Financial Advisor decides to target white female university professors, Age 40 and up.

From experience, Langston knows that most professors he’s encountered have the Ph.D. designation, but he wants a solid answer.

So he searches “average education level of full professors.”

Wikipedia tells him that “the vast majority of professors hold doctorate degrees. Professors at community colleges may only have a master’s degree while those at four-year institutions are often required to hold a doctorate or other terminal degree*.”

*highest degree level in a particular field

First, if you have a few dozen existing clients, do they have young children at home? Adult children in university, or in the workforce? Do you think either of these things are important to why or how they chose you?

When searching for “what percentage of university professors have children,” Langston finds that only 44% of women professors are married with children. This is compared to 70% of men.

And women are more likely not to have any young children living in the home by this age (40 to 55+).

First, if you have a few dozen existing clients, what have you learned about their passions or hobbies over the years? What are they? Have you noticed any patterns?

Let’s say our CDFA noticed that a lot of the white female professors would mention their pets (usually dogs), who they consider family, and who they believe are great for protection.

They often read or write short fiction in their spare time, and they have intimate get-togethers with their other divorced or single friends, involving wine, good TV, and laughter.

Now we must ask:

Do you think those patterns are significant to why or how they chose (or would choose) you?

Our CDFA reads between the lines and gleans that “protection, comfort, and security” would likely be important to his typical client. This new data helps in his business, too. Because now, he might recommend safer investments than usual, like Certificates of Deposit (CDs) and money market accounts, to see how clients respond.

Why this is important:

When you proactively serve your clients’ deepest needs — especially those they’ve not expressly shared — you appear more understanding. This increases their trust in you and their loyalty to your business.

Langston is happy to realize that his theory about how hobbies are important rings true with what he already knows about this market. His client is concerned about maintaining a level of comfort and financial security after their divorce, and they’re seeking to protect their assets. This is exactly why his Perfect Client would choose a CDFA.

But if hobbies, passions, or hobbies don’t seem important at this stage, no worries. You’ll grow to understand the correlations more as you develop a stronger picture of your Perfect Client over time.

This may not seem important at first glance. But people in different areas of the U.S. have very different personalities, pet peeves, ways of interacting with others… and incomes. And those are only a few of many crucial distinctions.

If you’re unsure which cities, consider what you DO know (or want to target), like occupation, income, and ethnicity. Then, search for the area of the U.S. that has the most of that combination of things (occupation, income, ethnicity).

Ex: Our African American financial advisor knows that he wants to target university professors. At this stage of business, he’s looking to extend his registration and services to clients outside of his home state.

So he’ll search “which states have the most university professors.” When he does, he finds that the top four states housing full professors are:

- California

- Minnesota

- Connecticut

- Wisconsin

Since the minimum income he wants his Perfect Client to have is $75K (established at the start), he waits to choose the top three until he does a little research on how location affects income.

Important Note: Also consider cost of living when deciding where your Perfect Client lives, to make sure the minimum income you chose puts them in the income class you envisioned.

Langston searches for “cost of living U.S. comparison chart by state” and finds (something called the “Cost of Living Index by State.” It uses a scale of 1 to 200, where 1 would be near free, and 200 would be outlandishly expensive.

- California: 151.7 (value of a dollar: $0.87)

- Minnesota: 101.6 (value of a dollar: $1.08)

- Connecticut: 127.7 (value of a dollar: $1.03)

- Wisconsin: 97.3 (value of a dollar: $1.08)

Looking at these numbers, he decides to try Wisconsin.

But as he goes to research what white people in Wisconsin are like (again, since he is a Black man), he finds that it’s the most segregated state in America. It’s also considered one of the worst places to live for people of color.

This new data makes him think it would be very difficult to get white clients from this area. Even still, he makes the decision to try targeting potential clients there as a test. He can easily switch the location of target later if he doesn’t get a good response.

When deciding on ideal income class, consider which you’d like to target:

- Upper Class: 1% of the U.S. (“old money” billionaires)

- New Money: 15% of the U.S. (TV/Hollywood celebrities)

- Middle Class: 34% of U.S. (“white collar”)

- Working Class: 30% of U.S. (“uniformed workers”)

- Poverty & Working Poor: 20% of U.S. (“check to check”)

Important Note: Across the years, I’ve found that many newer service providers asked this question always tend to choose upper class or new money. (Actually, most respondents chose the entire income range.)

This is a disaster for targeting quality, high-value prospects.

While we might like to have Oprah or Bill Gates as a client, we have to ask… is this realistic at our business’s current stage with its existing resources? Would they be our most likely audience? (Are we even currently on their radar? Meaning, do we operate in their circles, or can we gain [easy] access?)

As a good rule of thumb, it’s most practical and achievable to target a group one level above the networks we currently frequent. Then, once we gain a solid foothold in each new network, we reach up again.

Also, many people outright reject our lowest-income families, classified as the “working poor.” It’s important to point out that this group still spends up to 40% of income on things classified as “luxuries,” much like the other financial classes.

So depending on our goals and services we offer, it may not be wise to exclude this group from our targeting solely based on their income category.

Anyway, if you’re at this step and are not sure yet of your ideal client’s location, you can start with a loose salary based on the U.S. average for the chosen profession. (You can also do a search similar to “U.S. cities where professors earn the most” to help decide location.)

Otherwise, we can focus on annual household or personal income here, whatever makes the most sense for our needs. To get an idea of average yearly income for our Perfect Client in a particular field of work, for a particular area of the U.S., just search for “[job title] [salary] [city] [state].”

Langston wants to target a region that has the most professors, but he also wants them to make at least $75,000 per year and have a reasonably low cost of living.

Since we only have states so far, our advisor can first search “which wisconsin cities have the most universities.” He finds that the most and largest institutions are in Milwaukee and Madison.

So now, he can search “average full professor salary milwaukee, wi,” and “average full professor salary madison, wi.”

From Glassdoor, he finds:

- average full professor salary milwaukee, wi ($117,646)

- average full professor salary madison, wi ($154,127)

So he decides to target professors in Madison, WI. But he also lists the city and state where his own firm is located, because it will be easy to target his Perfect Client there, too.

Once you’ve gathered as much data as you can above, it’s time to consult search and social media to dig deeper.

Here’s where it gets fun. (Or creepy, depending on your perspective.)

Choose your three most perfect clients.

Find the primary online presences for those three, to include their most active social media profile(s).

Search their name and city/state in Google. It’ll be in top results. If you have an email address, try searching that, too.

Tip: If you’re profiling customers without any paying, ideal clients to speak of, your starting point is different. Instead, search for the top 2 to 3 most uniquely defining characteristics of your perfect client.

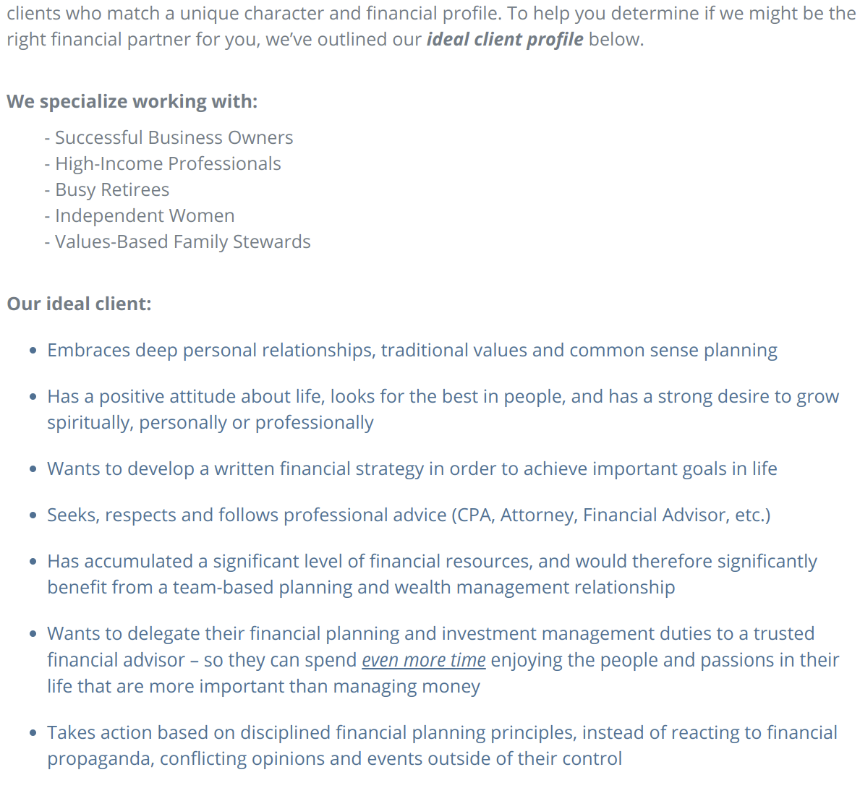

Example, these two: “divorced1 university professor2”

Then, make a list of people who most closely fit the profile you’ve outlined thus far.

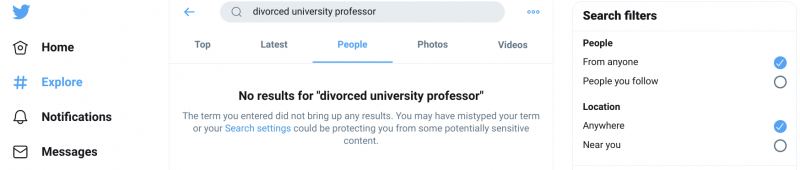

We like to start on social media for this search (Twitter, Facebook, LinkedIn) because it’s the most direct route, but that doesn’t always work.

Not too surprising in this case, because most people don’t broadcast that they’re divorced. It’s still unfortunately considered taboo.

We tried “university divorced,” but that brought up only two people on Twitter.

Depending on your Perfect Client, searching social profiles directly might be the long way around. So if that doesn’t work pretty quickly, search Google.

Our search for “divorced university professor” brought up excellent fodder in the top three search results:

Bingo.

One of these (2nd result) doesn’t fit our profile, because he’s male.

But the other, in the first result, fits perfectly: a 44-year-old Philosophy and Ethics professor at U. of Chicago. We’ll call her “Betty Dollywop” (so as not to rank on Google for this professor).

What’s important to them when making (buying) decisions?

Spend at least 15 minutes browsing each page or profile you’ve found in the steps above. Here’s where you start putting the pieces together to understand what they want when shopping with YOU.

NOTE: This post, while exhaustive, is just the tip of the iceberg when doing ideal customer profiling. Remember that we can always create the Ideal Client Profile for you.

You’re looking for things like:

- The language they use

- Important personality traits

- Their expectations and standards when dealing with others (business and personal)

- Hobbies and interests

- Passions

- Pet peeves

- Typical PEERS

- Relationship patterns w/others (how do they interact?)

- Allegiances (to a particular university? employer? clubs?)

- Overall outlook on life (pos? neg?)

Also pay attention to how they use the network. (This becomes important to how you market to them, and what you can expect from them, later.) Do they ask Qs? Only “broadcast” one way, not being really social or interactive? Do they use it hardly at all, unless it’s important? (If so, when is it “important” to them to post?)

But because “social media” life doesn’t always reflect real “social” life, try to read between the lines. And again, pay special attention to their language and wording.

So for Betty, we’ll take these notes:

- Language: Not a stickler for grammar (lowercase sentence starts)

- Personality: Extroverted, ethical, interactive/social, wry wit, doesn’t sweat the small stuff

- Expectations and standards: High ethics, fairness, open mindedness, consideration of others’ ideas

- Hobbies and interests: Writing, literature, authors’ perspectives, reading, art

- Passions: Philosophy, social justice

- Pet peeves: Being boxed in, oversocializing/small talk

- Typical PEERS: Intellects – other professors w/open views, witty writers, etc.

- Relationship patterns w/others: Will probably add to an interaction when she has something really valuable to impart

- Allegiances: Family

- Overall outlook on life: Amused. Free-spirited. Positive.

- Uses network: To engage w/”network friends” (who may not be real friends?), interactive, shares funny family anecdotes, few lengthy back and forths, but some interaction ONLY WHEN she has “something to add” to the conversation

- Reads: NYT, philosophers

The more of these you do, the more accurate your Perfect Client Profile will become. But remember that even within your market, people are people, so expect them to deviate from these “norms” you’re setting. These aren’t a box to put them in; these are a guideline for you to use, to understand what they want, what they need, and where to find them.

Continuing down the “divorced university professor” search results, we find another professor deeply embedded in an article on Page 2, a 59-year-old Professor of Law at Chase College. We’ll call her Tamela Charliehorse.

For Tamela, we would do the same process. We won’t repeat the process in this post since I’ve explained it already. But we can see many similarities between Betty and Tamela.

- Language: Defined, professional, intelligent

- Personality: Ethical, realist

- Expectations and standards: High ethics, fairness, justice

- Hobbies and interests: Christianity, gospel, proudly breaking through glass ceilings, changing policing, dancing, Spanish/languages, Black positivity, current events,

- Passions: Stopping human trafficking, ending racism, ending domestic violence (Human rights), ending human rights violations

- Allegiances: God, family, community, Delta (sorority)

- Overall outlook on life: Realistic, committed to positive change

- Uses network: To state or display strong opinions against injustices and wrongs

- Reads: NPR, CNN, Sirius/XM?, washington Post, BLACK news writers/reporters/perspectives

When you do this process yourself, be sure to do a few of these for your audience to become able to identify important patterns.

Identify important “excess” traits.

For your initial Ideal Customer Profile, for things like personality, expectations, and standards, only list those that you’re willing to deal with.

For negative or unacceptable traits, keep note of those somewhere outside of their profile so that we’re not surprised by certain behaviors or expectations when we encounter the total market. But we won’t list them here, because they’re not personalities we want to focus on attracting.

Some examples of “excess” or imbalanced positive traits:

- Extroverted: Self-absorbed

- Ethical: Judgmental

- Social: Over-talking; motor mouth

- Wry: Cynical

- Doesn’t sweat the small stuff: Inattentive to detail

- Fair: Indecisive

- Open minded: Noncommittal

- Considerate: Poor self care

- Free-spirited:

- Positive: Silly, playful

- Realistic: Cynical

- Change-agent: Unaccepting of others; domineering

- Expressive: Overbearing

- Professional: Overly formal, conservative, cold

- Intelligent: Haughty, arrogant

Then if you’d like, you can make a list of the excess/imbalanced traits to be wary of. Use them as red flags to note when you’ve attracted a personality type that may be problematic.

Use all data to understand their top media interests.

Here, we can simply search for the top book titles, media outlets, websites, etc., a certain person type uses. Remember that we’re trying to establish patterns, as opposed to digging deeply into ONE person’s preferences or idiosyncrasies.

For instance, both Betty and Tamela care deeply about human rights, ethics, and social justice. And of course, we’re targeting university professors.

So we can search GoodReads, Amazon, Google, etc., for:

- “top human rights books”

We’ll put the ones on our list that are mentioned on more than one “top” book list on the Internet.

So:

- I Am Malala

- To Kill a Mockingbird

- 1984 (not on more than one list we viewed, but a relevant classic)

- Disposable People

- Universal Human Rights in Theory and Practice

For sake of space, we won’t do it here… but we can also do another book search to find patterns across their other two shared interests: social justice and ethics.

Another good search to do is for books pertaining to our ideal client’s profession. So we can search for:

- “Best books for professors”

And we find these book selections on two or more book lists:

- Teaching College

- Small Teaching

- What the Best College Teachers Do

- etc.

Since we also know that professors generally like reading, we can take it a step further and search for books in other areas of their persona. For instance, “top books on divorce.”

See how far we can go with this research?

Also, if there are any really unique patterns between your audience members, we could also search for the most idiosyncratic patterns of those to explore further. (For instance, if they all happened to like deep sea diving, fondue, or baking.)

Depending on what your goal is with this research, you can go deeper if required. But if this is your first Perfect Client Profile, just two of the top choices for each category–websites, books, news sources or media–will more than suffice.

To find top news sites and media followed, we can search for this info, or we can just find our ideal client on social media and look at their follower lists (if possible).

The most obvious way is to find news media accounts that any two or more ideal clients are following.

For instance, Betty follows writers and editors from The New Atlantis, Wikimedia, The Atlantic, NYT, Pop-Up Magazine, Washington Post, NPR, The Guardian, Wired, Bloomberg, and many others.

Tamela follows The Root, Essence, CNN/MSNBC, Diversity Inc., BBC News (UK), The Guardian, Crooked Media, The New Yorker, MVMNT TV, Reuters, Forbes, NASA, The Daily Show, NYT, NPR, SiriusXM, Ebony, and more.

In this case, we see that they both like NYT, NPR, and The Guardian.

But if you don’t see any overlap in media outlets listed between your ideals, don’t worry. In those cases, focus instead on the topics the outlets cover. For example, we see patterns with them leaning toward alternative media, and outlets devoted to the protection of people.

At this point, you have your customer profile demographics and psychographics. This puts you leaps and bounds ahead of most other service providers.

You should now also have enough data to be able to establish many industry-specific preferences for the ideal clients in your particular field of work that you want to attract.

Again, we’re filling out this Ideal Client Profile for a financial analyst. So it would be valuable for financial professionals, for example, to pin down a few more details they may want to see, not see, or potentially see in their ideal client.

Examples:

- Current assets

- Current financial obligations

- Risk tolerance

- Real estate holdings

- Insurance holdings

- Types of investments they currently hold

- Types of investments they may be interested in

- Expected increase in assets in the near future

- Estate plan preferences

- Other advisors they may already work with (tax attorney, banker, CPA, insurance, etc.)

- When they plan to withdraw money from investment accounts (1 year? 10 years? etc.)

- Their HNW personality type

- Other future goals, preferences for the advisor relationship, etc.

Basically, anything from your company’s financial planning fact-finder or initial client questionnaire can also be used to narrow down your ideal client. And again, if you already have the planning data from previous clients that you consider ideal, definitely consult those to help build out these preferences.

Otherwise, like in the case of Langston, we can estimate this data using similar processes to what we’ve used so far.

Once you’ve got a solid, detailed profile on your ideal client, now it’s time to figure out where to find them. And with all the data you’ve gathered, this is the easiest part.

Basically, you’ll search for their interests within:

- Meetup.com

- LinkedIn groups

- Facebook groups

- Forums/discussion boards

- Associations

- Blogs

- Apps (iPhone, Android, iPad, Kindle, Amazon Fire, etc.)

- Local events/venues (EventBrite, Groupon)

Depending on your goals here, search within the places that make most the most sense to your research.

For instance:

- If your team is designing an app for investors and trying to decide on what platform would make the most sense, search apps.

- If you’re just trying to find your audience online, search within Meetup, social media groups, and forums/discussion boards.

If you’re trying to find them offline and locally, search for relevant venues, events, and associations.

A little customer profile analysis should be done if you find yourself wanting to target more than a single client type. (And that’s most of us.) Basically, analyze your initial Ideal Customer Profile with the goal of identifying where large subsets of clients fall outside those ranges.

Then, create a new, spin-off profile whenever you find major differences. We’re looking for big differences here that would cause material changes in how you speak to, reach, or serve your ideal client.

For example, some differences you may consider “major,” depending on your primary offer, could be:

- Female vs. male

- Baby boomer vs. Millennial

- Introvert vs. extrovert

- African American vs. Caucasian

- Etc.

Don’t get too cavalier in creating extra profiles, lest your team become wildly disorganized. But it is always good practice to, at the very least, build a new profile for prospects of a different generation or different ethnicity than your original ideal.

For prospects of a different gender, you can often just add that data to your original profile, but calling out the differences wherever they’re relevant.

How do you know when you need a separate customer persona?

If you have to target the new Ideal Client uniquely in terms of language or tone used, venue you reach them in, their strongest needs, their most pressing pain points, etc., it’s probably time to separate them out into a new profile.

This extensive profile will prove invaluable to your ongoing business and marketing efforts, so you should seek to incorporate it into your routine ASAP.

A good way to do that could be to rewrite it each day for a few weeks, because we know that note-taking speeds up retention and recall many times over when trying to memorize something…

…but you’re not going to do that.

Hell, I don’t even recommend that. Because I’m sure you, like I, would prefer to avoid that time-consuming drudgery at any cost, as our time is much better spent on actual revenue-producing activity.

But committing this to memory and putting it to use IS truly critical to your business.

So for focus and retention, I’d strongly recommend at least re-reading it at the beginning of each day for at least 14 days, but for no less than 5 days in a row.

Also, use common studying hacks, like:

Also, use common studying hacks, like:

- Taking notes on important portions of the PCP

- Reading it aloud

- Talking about it with your team

- Imagining specific scenarios where the PCP will ease your decision-making

- etc.

You want to get to a point where someone could ask you a question about how to deal with your ideal client, and you’re able to answer based on the data, not on a guess.

You should use this new document at every opportunity, all the time, everywhere possible, and whenever you remember it! Seriously.

Print it out and keep a copy on your desk, or pinned to your wall.

For instance, your team should use it when:

- Deciding what tonality or language to use on your website

- Deciding what pain points to address in your messaging

- Wondering where to find your ideal client

- Wondering how they make buying decisions

- Wondering what words or language to avoid when addressing your client

- Deciding what questions and topics are most relevant to them

- Deciding on brand colors and/or ad copy

- etc.

While all of the above may not be expressly present in your PCP, they can now definitely be supposed with an uncanny degree of accuracy.

Whenever you’re stumped on any decision that involves interacting with your ideal client, pull up your Ideal Client Profile and wonder no more. This will be priceless to your client attraction and client retention efforts. Enjoy!

Amazing article, This is something very informative. To be honest, I love this article and the way you have explained the things..Thanks Again 🙂

I’m glad it was useful, Priya – thank you. ♥

Its like you read my mind! You appear to know so much about this, like you wrote the

book in it or something. I think that you can do with a few pics to drive the message home a bit, but

other than that, this is magnificent blog.

A fantastic read. I will certainly be back.